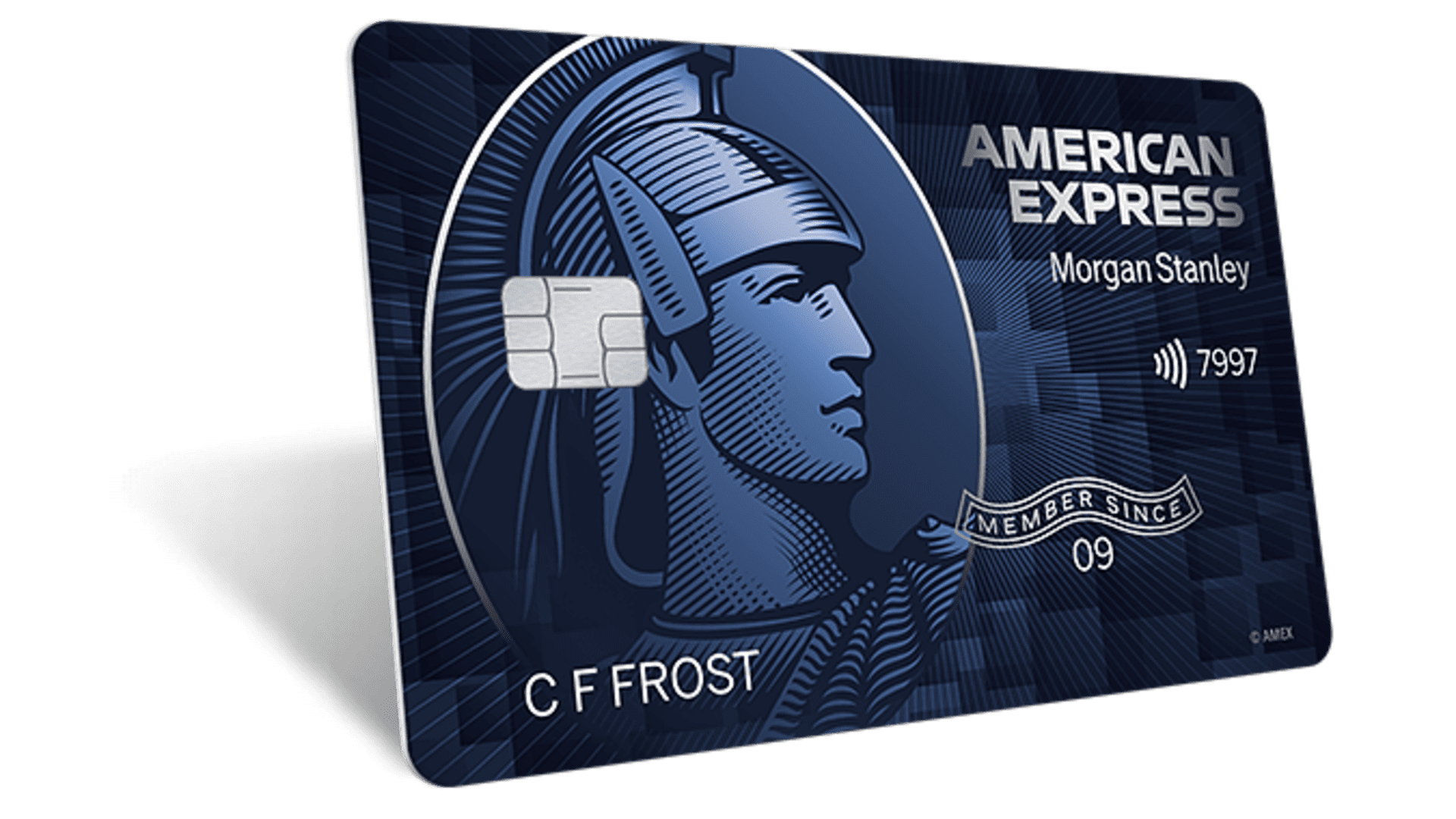

Investing in today’s complex financial landscape requires a comprehensive approach to credit risk management. Morgan Stanley Credit Options offer investors a robust set of solutions to effectively navigate this critical aspect of portfolio optimization. These innovative offerings empower clients to manage credit risk. Capitalize on market opportunities, and enhance the overall performance of their investment portfolios.

At the heart of Morgan Stanley Credit Options are innovative fixed income securities and structured products. These credit-focused solutions provide investors with access to a suite of advanced tools, including interest rate derivatives and hedging strategies, designed to help mitigate risk and unlock new avenues for growth. The firm’s experts leverage their deep market insights and analytical prowess to guide clients through the ever-evolving world of credit risk management, fixed income securities, and structured products.

By partnering with Morgan Stanley, investors can navigate the complexities of bond trading and credit analysis with confidence. The firm’s comprehensive approach to credit risk management ensures clients can make informed decisions and position their portfolios for long-term success, regardless of market conditions. With Morgan Stanley Credit Options, investors can reach new heights in their financial journeys.

Navigating the World of Credit Risk Management

Credit risk management is a critical component of successful investing. Morgan Stanley’s experts provide guidance on navigating this landscape, starting with an in-depth understanding of credit default swaps. These derivatives allow investors to manage credit risk by transferring the risk of default on a bond or other debt instrument to a third party.

Understanding Credit Default Swaps

Credit default swaps are a widely used tool for managing credit risk. These financial contracts enable investors to transfer the risk of default on a bond or other debt instrument to a third party, known as the protection seller. By purchasing a credit default swap, investors can hedge against the potential default of a bond or other fixed income security. Providing them with an additional layer of protection in their investment portfolios.

Evaluating Corporate Bonds and Debt Instruments

Morgan Stanley’s comprehensive approach to credit risk management also involves a thorough evaluation of corporate bonds and debt instruments. The firm’s analysts assess the creditworthiness of issuers, the terms and covenants of the securities. And the potential risks and rewards associated with each investment. This analysis helps clients make well-informed decisions when adding fixed income products to their portfolios.

Exploring Fixed Income Securities and Structured Products

Beyond traditional bonds, Morgan Stanley’s credit solutions encompass a range of fixed income securities and structured products. These innovative offerings can provide diversification, enhanced returns, and specialized risk management features tailored to the client’s needs. The firm’s experts guide investors through the nuances of these complex instruments, ensuring they understand the potential risks and benefits.

Morgan Stanley Credit Options: Your Gateway to Innovative Solutions

Morgan Stanley’s Credit Options provide clients with access to a suite of advanced tools. And strategies to manage interest rate risk and optimize portfolio performance. The firm’s experts work closely with investors to develop customized interest rate derivatives solutions. Such as swaps and options, to hedge against potential market fluctuations. This comprehensive approach to credit risk management also includes ongoing credit analysis. And risk monitoring to ensure clients’ portfolios remain aligned with their investment goals.

Interest Rate Derivatives and Hedging Strategies

At the core of Morgan Stanley’s Credit Options is a robust credit analysis and risk monitoring framework. The firm’s team of analysts delves deep into the creditworthiness of issuers, industry trends, and macroeconomic factors to identify potential risks and opportunities. This rigorous process enables clients to make informed decisions and proactively manage their credit exposure, ultimately enhancing the long-term performance of their investment portfolios.

Comprehensive Credit Analysis and Risk Monitoring

Morgan Stanley’s Credit Options provide clients with access to a suite of advanced tools. And strategies to manage interest rate risk and optimize portfolio performance. The firm’s experts work closely with investors to develop customized hedging strategies. Such as swaps and options, to mitigate potential market fluctuations. This comprehensive approach to credit risk management also includes ongoing credit analysis. And risk monitoring to ensure clients’ portfolios remain aligned with their investment goals.

Capitalizing on Market Opportunities with Morgan Stanley

At Morgan Stanley, our expertise extends beyond credit risk management into the realm of bond trading and liquidity management. Our team of seasoned traders and market analysts constantly monitor market conditions. Identifying undervalued or mispriced securities that present attractive bond trading opportunities. By executing strategic trades, we help our clients capture potential upside and capitalize on emerging market trends.

Maintaining ample liquidity management is a key focus for Morgan Stanley, as it ensures our clients can access their investments when needed. This flexibility empowers them to seize new market opportunities as they arise, whether it’s taking advantage of market dislocations or pursuing alternative investment strategies to enhance portfolio performance.

Bond Trading and Liquidity Management

Our bond trading desk leverages its deep market insights and extensive industry relationships to identify and execute trades that can generate attractive returns for our clients. By closely monitoring market conditions and analyzing the creditworthiness of issuers, our traders are able to identify undervalued fixed income securities and capture potential price appreciation.

Complementing our bond trading capabilities, Morgan Stanley’s liquidity management solutions provide clients with the flexibility to access their investments when necessary. This, in turn, allows them to swiftly respond to changing market dynamics and seize new opportunities that align with their investment objectives and risk tolerance.

| Key Capabilities | Benefits |

|---|---|

| Bond Trading |

|

| Liquidity Management |

|

By leveraging Morgan Stanley’s expertise in bond trading and liquidity management, our clients are empowered to capitalize on market opportunities and enhance the overall performance of their investment portfolios.